Here are four top tips for first-time buyers

Article written by Holly Mead from The Sun

RISING property prices are making it harder than ever for first-time buyers to get at foot on the ladder.

But mortgage broker Carmen Green has these tips for aspiring homeowners.

Carmen, 26, is a mortgage adviser at Surrey-based mortgage brokerage Xpress mortgages.

She started working at the brokerage at age 18, “when I had no idea what a mortgage even was”, but soon trained up and qualified for her current role.

Carmen says the most common worry that first-time buyers have is around their spending.

She said: “The question I get asked most is ‘do I need to stop spending money so my bank statements look healthy?’”

“I advise clients to go through their bank statements and consider if they were the one about to lend hundreds of thousands of pounds out.

“What might raise concerns to you? Is the person gambling, in an overdraft regularly, or spending every penny each month with no buffer?”

“It’s a window into someone’s spending habits.

But that doesn’t mean buyers have to curb all of their spending to get a mortgage, Carmen adds.

Instead, she says it’s important to show you are in control of your finances and not living beyond your means.

So there’s no need to panic because you have a holiday book or splurged for a big birthday treat, as it’s about the overall picture not just one purchase.

As well as the common questions such as this, Carmen gets some more unusual ones too.

She adds: “I recently had a client send me a photo of a pile of euros under their bed and ask if that was suitable proof of deposit.

“It turns out there was a very valid reason they had that stash of cash but it wasn’t easy getting it through the money laundering and compliance checks!”

Another client was reluctant to hand over their bank statements.

“Without going into detail, I would say be mindful of what you name money transfers to your friends – as not all mortgage underwriters will share your sense of humour,” said Carmen.

So with that in mind, here are her four top tips for first-time buyers:

Set a budget

Setting a budget is one of the first things any aspiring homebuyer needs to do -this couple set a £50 a week rule.

And it’s not just about working out what property price you can afford.

Remember to factor in all the extras such as solicitor fees, stamp duty, moving costs and even the cost of furnishing your home.

Carmen said: “Once you have worked out the costs of buying, you can calculate how much deposit you can put down and how much you can afford on the monthly mortgage repayments.”

And don’t forget to factor in any potential changes in your circumstances: are you expecting to change job, have a baby, or see an increase in travel costs, for example?

These will all affect what you can afford to repay each month – and how much you can borrow.

Check your credit file

Your credit score is one of the things any lender will look at before deciding whether to give you a mortgage or not.

That means you need to make sure it’s in as good a shape as possible.

Any bad credit registered against you such as missed or late payments, defaults, or County Court Judgements, will be flagged to a lender.

You can do a free “soft check” or your credit file through credit agencies such as Experian and Equifax.

This will help you understand how good your credit profile is, and also let you spot if there are any mistakes on it.

A mortgage adviser can help you go through the file if you’re not sure what to look for, as well as giving you tips on how to improve it.

“It’s not uncommon for an incorrect missed or late payment to be on your file causing a negative impact, so spotting this means you can get it removed before you apply for a mortgage.”

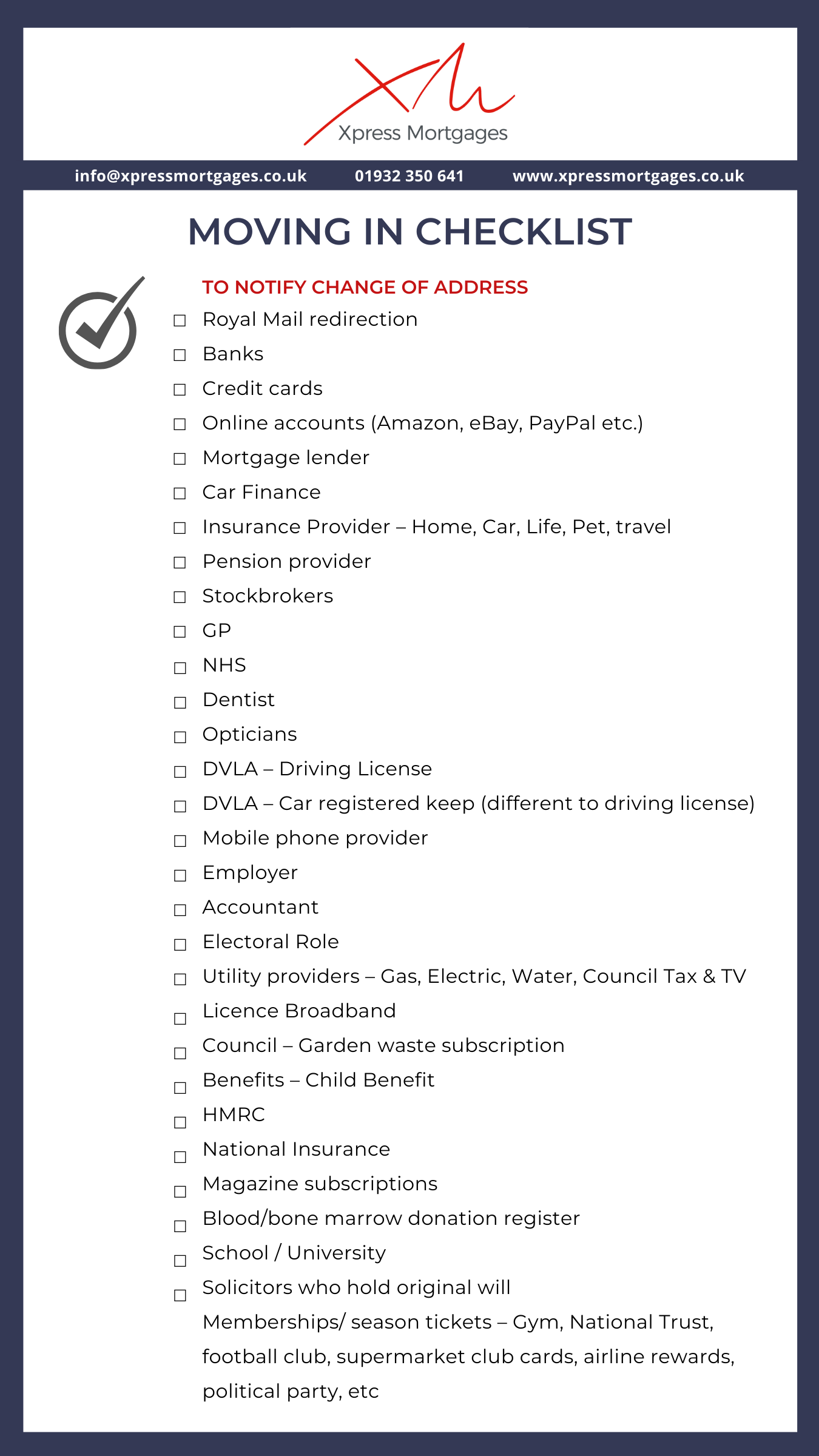

Sort your documents

Buying a property means a LOT of admin, so it makes sense to get all your paperwork up to date and in place.

You’ll need all ID documents such as a driving licence or passport, payslips, a p60, bank statements and any recent accounts if you’re self-employed.

Make sure everything is registered to the correct address and that any ID is still valid.

Having all this to hand before you start the process can make it a lot less stressful.

“As a mortgage broker, it also means I can do my research and give advice more accurately too,” said Carmen.

Choose your location

The saying “location, location, location” exists for a reason – choosing where to live is important.

Once you settle on an area in which to conduct your property search, you’ll have to do some research into property prices there and see what you can afford.

Carmen said: “It might be that you can’t afford the four-bed house you saw on Zoopla and fell in love with.

“Ask yourself, would you prefer to look in a different location to buy a similar-sized house, or stick to the same area and get something slightly smaller?”

Thinking about how long you plan to stay in a property or whether you’ll need more space in the future, for example, are also important to consider.

There are some buying schemes that could help you afford a home in your top area, such as Shared Ownership Schemes, so these may also be worth investigating.

Plenty of our My First Home first-time buyers have used these schemes to get on the ladder.

Carmen said: “Being able to share the excitement a client feels at buying their first home or a new home is the best thing about my job – it never gets old.

“And if I can save clients thousands of pounds by getting them a good mortgage deal or remortgaging them, that feels good too as so many people often don’t realise how much they can save.”

01932 350 641

info@xpressmortgages.co.uk

www.xpressmortgages.co.uk